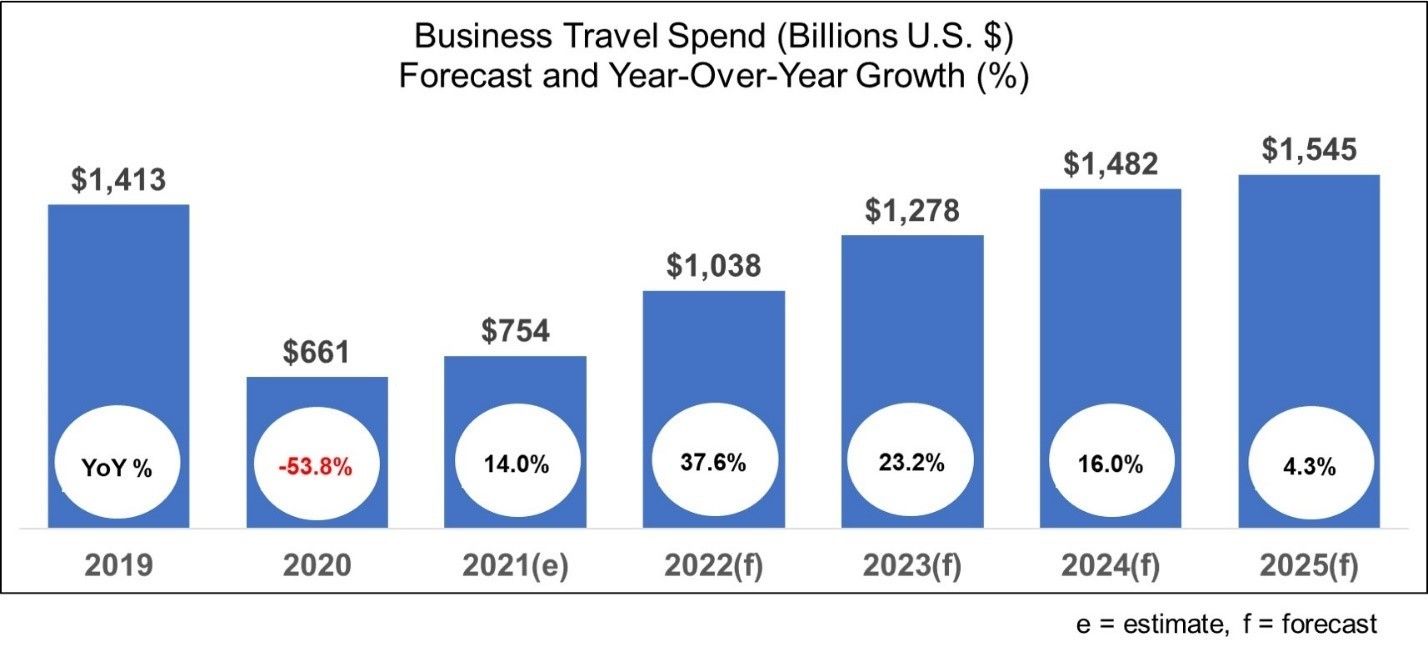

While the recovery of business travel in 2021 has proceeded

at a slower pace than predicted last year, global business travel spend is

expected to surge in 2022 and fully recover by the end of 2024 – a year earlier

than originally anticipated, according to a survey by the Global Business

Travel Association.

The results of the 13th annual BTI Outlook, the

GBTA’s annual study of business travel spending and growth covering 73

countries and 44 industries, found that after a sharp 53.8 per cent decline in

spending to US$661 billion in 2020, global expenditures are predicted to have

rebounded 14 per cent in 2021 to $754 billion. This recovery happened more

slowly than forecast in the last BTI Outlook, which was published in February

this year.

North America – the US in particular – led the recovery,

with spend rebounding 27 per cent in 2021, with markets in Latin America,

Middle East and Africa, and Asia-Pacific all picking up 15 to 20 per cent growth.

Europe lagged behind the rest of the world, only gaining 10 per cent this year.

The situation is worse in Western Europe, where expenditure for 2021 are

expected to fall 3.8 per cent from 2020 levels. According to the GBTA, this

stems from underperformance earlier in the year, but business travel demand in

the region is set to outpace most other parts of the world, barring any further

pandemic-related setbacks.

Despite this slow start, survey respondents are predicting a

year-on-year spending surge of 38 per cent in 2022 as travel’s recovery and

pent-up demand kicks up a notch, potentially bringing global business travel

spend back to more than $1 trillion. This trend will continue in 2023, with spending

rising 23 per cent as more international and group travel returns. By the end

of 2024, the numbers are expected to make a full recovery to just above

pre-pandemic levels at $1.48 trillion.

This growth is forecast to slow in 2025 to a more modest 4.3

per cent, ending the year at $1.5 trillion.

However, challenges remain on the road to recovery, with

survey respondents pointing out factors such as persistent Covid-related

threats and disruptions, supply chain issues, labour shortages, rising

inflation, increased costs and lagging recovery in Asian markets as key risks

for on-target recovery.

The GBTA said it is also yet to be determined how the broad

adoption of remote working, long-term cuts or elimination of business trips and

travel volume, and the increased focus on sustainability practices and policies

might impact spending levels.

Suzanne Neufang, CEO of the GBTA, said: “Of any year we’ve

issued the BTI Outlook forecast, this one was the most anticipated and it’s no

surprise. The business travel industry recognises there are factors, related to

Covid-19 and beyond, that could impact the road ahead over the coming years.

However, there is optimism overall as the industry, companies and travellers

worldwide lean into recovery and the much-needed return to business travel.”

Credit: GBTA BTI Outlook

Credit: GBTA BTI Outlook

Different perspectives

This year’s index featured for the first time views from C-Suite level finance professionals

and business travellers.

In a poll of 40 CFOs across North America, Latin America,

Asia-Pacific and Europe, 70 per cent said they feel the overall economy in

their country would be better in 2022 than it has been in 2021. Encouragingly,

about half (52 per cent) believe their company’s travel spend would reach 2019

levels in 2022.

When asked about the importance of business travel to their

organisation, CFOs felt top return-on-investment factors are sales and business

development (68 per cent), internal business planning and strategy (50 per

cent), client account management (48 per cent) and employee training and

development (48 per cent).

Meanwhile, among 400 global business travellers surveyed, 86

per cent agree they need to travel to accomplish their business goals.

Eighty-one per cent believe their volume of domestic travel will be greater or

on par with pre-pandemic levels in 2022.

While more than half (54 per cent) said they miss travelling

for work and hope to do so more often in the future, 43 per cent said they

would not mind travelling less, whether they indicated they miss doing so or

not.

Around four in five business travellers said their employer now

requires Covid-19 vaccines for travel and in-person meetings.

Challenges ahead

While global GDP growth is expected to reach 5.8 per cent this year and 4.2 per

cent in 2022, downward revisions could be caused by another wave of Covid,

further deceleration in the Chinese market, or a worsening of the energy

shortage experienced in recent months.

The BTI Outlook lays out four conditions necessary for the

full recovery of business travel. These are:

- 1.The global vaccination effort

- 2.National travel policy

- 3.Business traveller sentiment

- 4.Corporate travel management policy.

The GBTA said recovery is heavily dependent on the global vaccine

rollout, employees’ return to the office and a normalisation of travel policies

on both the corporate and national levels. Travel managers are also now facing

the challenge of balancing duty of care with rising costs, sustainability

priorities and new considerations on the ROI of business travel.

The BTI Outlook was conducted in partnership with Rockport Analytics and HRS.