Last month’s announcement by Air France-KLM of a surcharge to fund the sister carriers’ investment in Sustainable Aviation Fuel provoked strong debate over whether this was a reasonable additional cost or not.

Yet whatever else one may think about the SAF surcharge, at least it is small (€1-€12) and ring-fenced for an identified purpose. It is often forgotten that air passengers routinely pay far larger surcharges that can amount to more than €1000 as part of their ticket, and with no clarity about what these “carrier-imposed surcharges” are for.

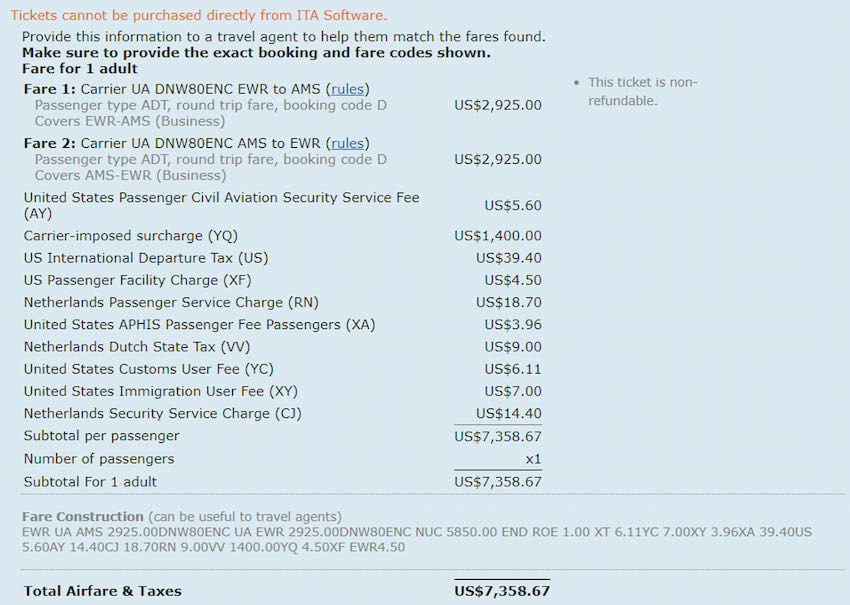

To the right is an example (click to enlarge), a business class return from Newark to Amsterdam on United Airlines, where the base fare of US$5850 is accompanied by a carrier-imposed surcharge of $1400.

How the total price is broken down is extremely important for corporate clients, according to one travel manager who asked not to be named but is deeply unhappy with the situation. “For corporates it’s meaningful because you don’t get a discount on the carrier-imposed surcharge,” the buyer said.

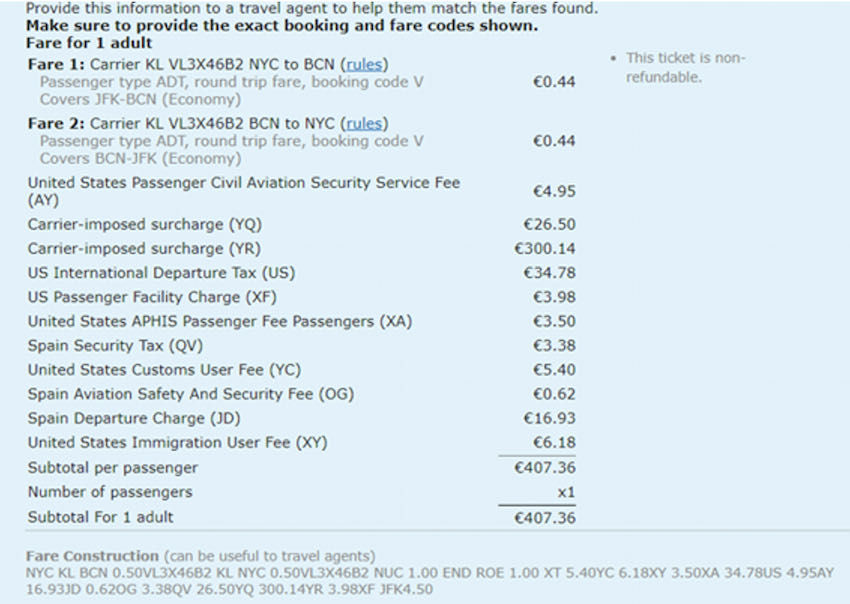

At their most extreme, carrier-imposed surcharges (also known as YQ/YR – the two boxes in which the surcharges appear on the ticket) can account for almost the entire ticket price, less taxes and airport fees, such as this offering (right) from KLM.

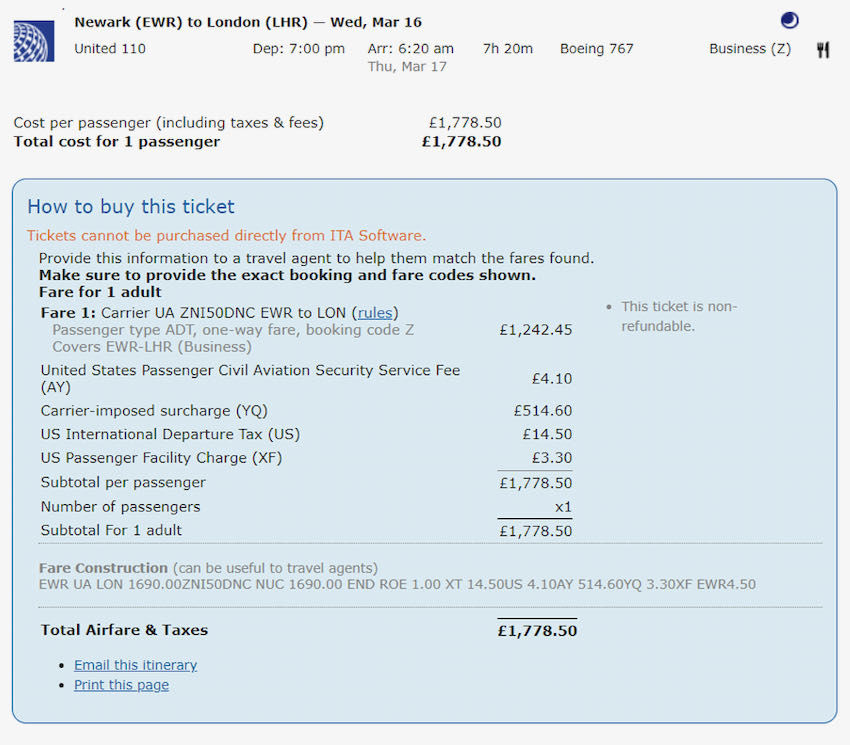

This particular example would rarely be an appropriate fare for business travellers because, for instance, it includes a Saturday night stay. But higher fare classes that do attract discounts like this one in Z class, again from United, can also be accompanied by hefty surcharges (below right).

For this fare, a theoretical ten per cent discount for a corporate client would effectively become 7 per cent because of the exclusion of £514.60 (plus taxes and airport charges) from eligibility for reduction.

“You can’t really follow or challenge these surcharges,” says Jörg Martin, owner of Germany-based CTC Corporate Travel Consulting. “In a lot of cases only 50 or 60 per cent of the fare is negotiable. In extreme cases it’s only a single-figure percentage.”

Historically, YQ and YR surcharges were labelled as fuel surcharges and used heavily by airlines when the price of oil surged from $20 per barrel in 2002 to a high of $145 in 2008. By 2016 oil had dropped to around $50 but many airlines were tardy in removing their surcharges accordingly and in some cases reduced them little or not at all.

By the middle of the 2010s all pretence of aligning YQ and YR to fuel surcharges was abandoned and airlines switched to labelling them “international” or “carrier-imposed” surcharges instead.

The current price of Brent Crude oil is $87. “A link between surcharges and fuel consumption doesn’t exist,” says the travel manager. “A typical actual cost of aviation fuel on a Boeing 787 is $100 per passenger from New York to London, assuming there are 250 seats on the plane and 80 per cent of them are filled.” YQ/YR surcharges are often several times that amount.

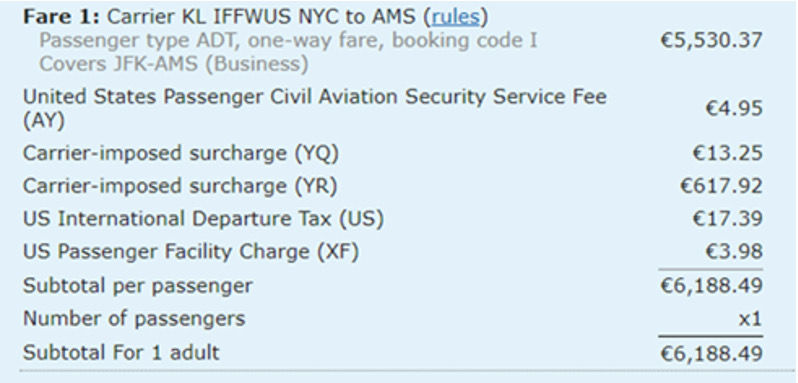

Other hard-to-explain inconsistencies abound. For example, on this service from Amsterdam to New York YQ and YR amount to €227.50 (see right).

Yet with the same carrier but travelling in the opposite direction, from New York to Amsterdam, the YQ and YR surcharges total €631.17 (below right).

The only difference, other than direction of travel, is the fare classes, although both are in the business class cabin. YQ and YR surcharges tend to be heaviest on fares from the US but certainly exist in other regions as well.

All legacy carriers (but no low-cost carriers) include YQ/YR surcharges in some of their pricing. BTN Europe contacted the two airlines whose fares happen to be analysed in this article for comment – and we should add that the practice is widespread; these were simply the examples brought to our attention.

In response to detailed questions about the basis on which it splits pricing between the base fare and YQ/YR, and whether this is partly to reduce the percentage of the total fare eligible for corporate discount, United Airlines said: “United does not publicly discuss its pricing strategies. United discloses the entire cost of a ticket inclusive of taxes, fees, and surcharges on the initial display so all customers know the full cost before booking.”

KLM was far more forthcoming. “The discounts given to corporate clients indeed apply to the base fare,” it said. “This is well known by our clients, and is an industry practice. The carrier-imposed surcharge is a fare component, like the base fare, which is used to determine the all-in fares (when adding the airport taxes). The amount of carrier-imposed surcharge is based on competitive benchmark, and as such can evolve depending on the supply and demand of the market.”

Asked whether there is any link between YQ/YR and oil price, KLM went on to say: “Air France/KLM uses the carrier-imposed surcharge as a fare component, which is not based on costs.” The airline provided an example of identical surcharges to its own imposed by another carrier on the same route and fare class.

In summary, therefore, YQ/YR surcharges appear to be arbitrary other than corresponding to what competing airlines charge. If other carriers also assign a large portion of their ticket price to the YQ/YR boxes, there is little incentive for an airline to take the initiative and reassign its surcharges as base fare instead.

However, that is exactly what LATAM did a couple of years ago on a large number of routes within and from South America, according to the travel manager. Its competitors largely followed suit. “Airlines say they can’t be the first mover but LATAM did it,” the travel manager says.

There are no easy ways for travel managers to deal with carrier-imposed surcharges. “Surcharges aren’t broken out in reporting,” says Gavin Smith, director of Element Travel Technology. “It’s very difficult to analyse from a business intelligence perspective to really understand how much that is costing your business.”

Difficult, but not impossible. The anonymous travel manager has done so and is using the analysis to persuade airlines to clarify their corporate pricing.

Smith thinks buyers should also act collectively to bring about change. “It’s an ambiguous and slightly disingenuous way of revenue management by pushing it on to YQ or YR,” he says. “As an industry we should be challenging it through the legal processes.”