Travel buyers: strap yourselves in. Average ticket prices for corporate air travel are suddenly shooting skywards.

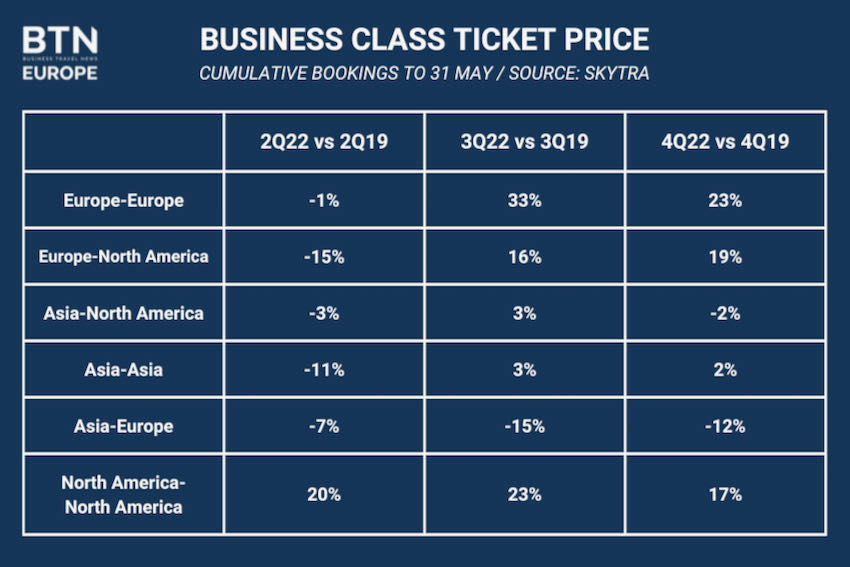

Intra-European business class fares booked to date for July-September 2022 are 33 per cent higher than the equivalent period in 2019, according to air fare benchmark administrator Skytra, a subsidiary of Airbus. That’s a significant pivot from April-June 2022, when fares were one per cent lower than the same quarter three years ago.

It is a similar story for transatlantic business class. Fares versus 2019 were down 15 per cent in Q2 but have rocketed to 16 per cent higher for Q3. Europe-Asia remains depressed, however, largely because of China’s slowness in reopening. Fares were seven per cent lower versus in Q2 and are currently 15 per cent lower in Q3.

Aurélie Duprez, founding partner of Areka Consulting, confirms corporate buyers can expect a rough ride. “We’re telling our clients they can expect their average ticket price to go up 20-30 per cent this year,” she says.

A multitude of factors are aligning to force up the average price paid. The most obvious reason – though far from the only one – is that airlines are increasing base fares and surcharges, especially in the form of surcharges for fuel and other costs.

One financial institution travel manager, requesting anonymity, says he is seeing surcharge increases of “a couple of hundred euros” in some cases and that “many times airlines don’t even tell corporate customers they are doing this.”

BTN Europe has written previously about the total lack of transparency of airline surcharges. As a result, while fuel hikes are undoubtedly hurting many airlines, with the International Air Transport Association reporting oil costs up 40 per cent for its members, it is impossible to judge when increases are necessary and when they are opportunistic.

“Fuel prices are incredibly high but some airlines are hedged with their fuel buying, so they are making good margins right now because they have locked in a low price,” says Skytra co-founder and chief sales and marketing officer Elise Weber. “Given that demand is so high, they can charge more.”

Pushing up price through increasing surcharges rather than base fares is especially damaging for corporate clients because airlines do not apply negotiated discounts to the proportion presented as a surcharge. “Clients are saying it is unfair,” says Duprez.

In addition to fare increases, average ticket price is being driven higher by companies resuming long-haul travel after the pandemic, according to both Duprez and CWT senior director for global supplier management Varinder Atwal. As a result, average journeys are longer and therefore inherently dearer.

Another contributory factor, says the anonymous travel manager, is that his travellers have not yet quit the habit they formed during the pandemic of booking much closer to departure – typically up to seven days ahead compared with three weeks in 2019. ”If you book London-New York only a week in advance, it’s going to be a much more expensive ticket,” he says.

This particular travel manager has also found his buying power diminished. With airline capacity still below pre-pandemic levels but demand booming in the leisure market and some corporate sectors, those companies which have not returned to anything like 2019 volumes are finding themselves less attractive prospects when they reach the negotiating table.

“Our bookings are down 75-80 per cent compared with pre-pandemic,” says the travel manager. “We’ve seen in some negotiations that airlines are reducing their discounts. They are applying levels of discount they previously awarded to small and medium enterprises.” In such cases, he added, there is likely to be only a standard 5 per cent discount, especially as airlines have fewer sales staff than pre-pandemic to manage corporate accounts like his.

His company is not the only one. “It’s true that in some cases, even with very large clients, discounts are being downgraded,” says Duprez. “Clients are expecting fare increases and they are expecting hard negotiations this year.” In some cases, she adds, airlines are instead “offering some other benefits as compensation, such as priority boarding or lounge access.”

Supply and demand factors are also combining in another unusual way to thwart savings. “We can expect 20 per cent fare rises on some routes because airlines have taken the opportunity to reshape their networks. They have stopped a number of routes that are not profitable, so there are going to be routes where there is just one direct option and buyers have no negotiation power,” says Duprez.

“At the same time, travellers are not as willing to take connecting flights as they were pre-Covid. They want more comfort. I see a number of organisations changing their policy in that respect, with less pushing of travellers to fly indirectly.”

Richard Johnson, senior director for travel management company CWT’s Solutions Group consulting business agrees, and throws Planet as a consideration into the mix alongside People and Profit. Acting sustainably can push up the average ticket price, Johnson believes, whether through lower travel volumes reducing buying power, or through favouring direct flights, which cost more financially but less in terms of carbon. “With that realisation comes slightly less budget sensitivity,” he says. “The acknowledgement of paying a bit more to achieve those ends is starting to embed.”

IATA is assuming global gross domestic product will grow 3.4 per cent this year and says total airline expenses will rise 44 per cent versus 2021 owing to “larger operations and cost inflation”. It all points to even higher ticket prices ahead. But, asks Atwal, is setting a tough pricing environment for corporate customers “short-sighted when you don’t know in the long term what is out there?”

The travel manager thinks the answer to that question could be yes, and that airlines may yet find themselves grateful for reliably regular corporate business. “Once initial demand is satisfied, you have inflationary pressures ticking away, and the first thing people will cut back on will be holidays,” the travel manager says. “You have cost pressures on companies as well as households. What we have now is a seller’s market but I’m not sure this will continue for a long time.”