Travel management company CWT and “lodging-as-a-service” (as it now

styles itself) provider HRS have both issued 2024 hotel negotiation planning

reports in recent weeks. Both make the same recommendation to buyers: integrate

your spend.

CWT urges companies to offer hotels not only their regular transient

business travel spend but as much of their meetings and events business as they

can muster too. This is especially important now because many of those

companies are booking fewer room nights than they did pre-pandemic. “As travel

buyers find themselves with less volume to offer for negotiating power they are

repeatedly seeking to weave in M&E volume as compensation,” says CWT.

HRS goes even further in suggesting additional types of spend to throw

into the negotiating pot, including long-stay bookings, day use of hotels and

“bleisure” – employees tacking nights on to their business trip for leisure

purposes. According to HRS, “Converging all lodging spend can deliver savings

of up to 16 per cent on bundled programmes.”

The logic of integrating spend sounds compelling, and has been advocated

for many years, but does it work? Not necessarily, according to independent

consultant Kevin Iwamoto, whose career has included spells as a travel manager

and as a strategic meetings management professional. “In theory, any time you can combine volume

you can negotiate something better. In practice it’s far more challenging.”

Another sceptic is Meenaz Diamond, senior vice president for M&E,

airlines and marketing at the Accor hotel

group. Asked how she responds to

corporate clients suggesting a combined negotiation, she says: “Show me the

data and show me the predictability. Let’s have a conversation and look at it.

I wouldn’t say no straight away but my instinct would be to say no because I

know all of the issues that are involved in meetings and events compared to

business travel.”

Diamond has several reasons for believing travel and meetings need to be

handled separately. First, there is the question of data. Corporate clients

tend to have good visibility of their transient spend; of their meetings spend

rather less so.

Then there is the difficulty of setting an appropriate blanket discount

in advance for meetings in the same way as for transient. That does not work

well for either the buyer or the seller, Diamond believes. For the buyer, each

meeting is different, thereby requiring a longer conversation.

“Anything beyond

a repetitive 10 to 15-person training kind of meeting has additional bells and

whistles attached to it,” she says. “They might be small bells and whistles but

they are there. You need food and beverage, audio-visual and so on. It’s more

of an investment in many ways, so the terms and conditions are different.”

And the promise of additional business does not necessarily help the

hotel supplier either. “Companies have a tough time understanding that ‘Well, I’m

giving you lots of business, I need a better rate,’ doesn’t always work,” Diamond

says. “Actually, it may not fit the composition of business those hotels are

looking for.”

Like Diamond, Iwamoto also identifies lack of comprehensive data on

meetings spend as a culprit, a challenge linked to travel typically having one

owner within an organisation but meetings having several. A survey by HRS found

that only 25 per cent of travel managers say their team has ownership of

meetings management.

An integrated negotiation only has a chance of succeeding, in Iwamoto’s

view, if those responsible for the two categories work together. Can vendors

smell disunity? “I pity the buyer who doesn’t realise how astute suppliers

are,” Iwamoto says. “The suppliers will recognise that right away.”

Such is the case for the prosecution against integrated negotiations. But

the defence also presents a robust argument. “I would say about 60 per cent of

the time we are in negotiations with hotels with events as part of the

negotiation,” says Pat Batra, executive director for travel, expense and fleet

at Olympus Corporation.

“From my vantage this is a total spend. Hotel chains claim there are

different requirements and you need different skill sets, and the needs of the

customers are different. I get it, but it’s all coming into the same property. You

could add another 5-10 per cent to your overall savings on your global spend if

meetings and travel are integrated.”

Circumstances are, Batra admits, especially propitious for his company to

integrate. Olympus has a very close relationship with one particular hotel

chain. But this is by no means uncommon.

Hyatt EMEA vice president for revenue,

sales and distribution Paul Dalgleish says his chain has a global enterprise

programme for 47 major clients which gives each of them a discount on the

totality of their spend. Average combined spend with Hyatt by its global

enterprise customers is six times higher than that of its regular corporate clients. “This

is a growing area that we want to expand, and to work with the right customers

to get their people into our hotel,” he says.

Client spend rolled up by Hyatt includes not only transient travel but meetings, extended stay and even the

holidays of clients’ employees. Dalgleish is confident the latter can be

tracked and assigned satisfactorily, and can amount to a significant sum in the

case of companies with ten or even hundreds of thousands of employees.

If travel buyers want to pursue the integrated option, they need to start

a data hunt and form an internal coalition with whoever has responsibility with

the procurement team for meetings, according to Iwamoto. Key to making that

coalition successful, he says, is “trusting each other to ensure their specific

needs are met. You don’t want to get into a competition of ‘My spend is larger

than yours, so I should have more say in the supplier selection’. Whatever the

differences or variances may be, the internal corporate coalition has got to

get its strategy and processes aligned before it sits down with suppliers or

even sends out a combined RFP.”

Meanwhile, Batra urges flexibility by buyers not always to hold the

supplier to the agreement. “Sometime you have to understand that a certain

supplier may not be profitable. In some cases we have accepted changes to a

contract because the hotel was so small that it was struggling,” he says. “We

want to come back next quarter or next year and we want to make sure that it’s

a healthy relationship. You have to be fair to suppliers.”

Batra adds that buyers must extend the same flexibility to their internal

customers. Sometimes the contracted hotel supplier in question may not have appropriate

accommodation for the needs of a particular meeting.

That’s why, says Diamond, if an integrated approach is going to succeed,

clients need to present suppliers not only with historical spend data but a forward

schedule of quarterly meetings, annual conferences, sales training and other expected

events. “Show us what the planning is,” she says. “It doesn’t have to be set in

stone. We know things change. But it’s about transparency – having that

sensible conversation.”

Even with her wariness based on lengthy

experience of integrated negotiations, therefore, Diamond adds: “It’s not to

say that it’s not possible. But it’s a dialogue. It’s much more nuanced and

it’s not just about sending out an RFP and saying ‘Respond in ten days, here

are the terms and conditions, take or leave it’.”

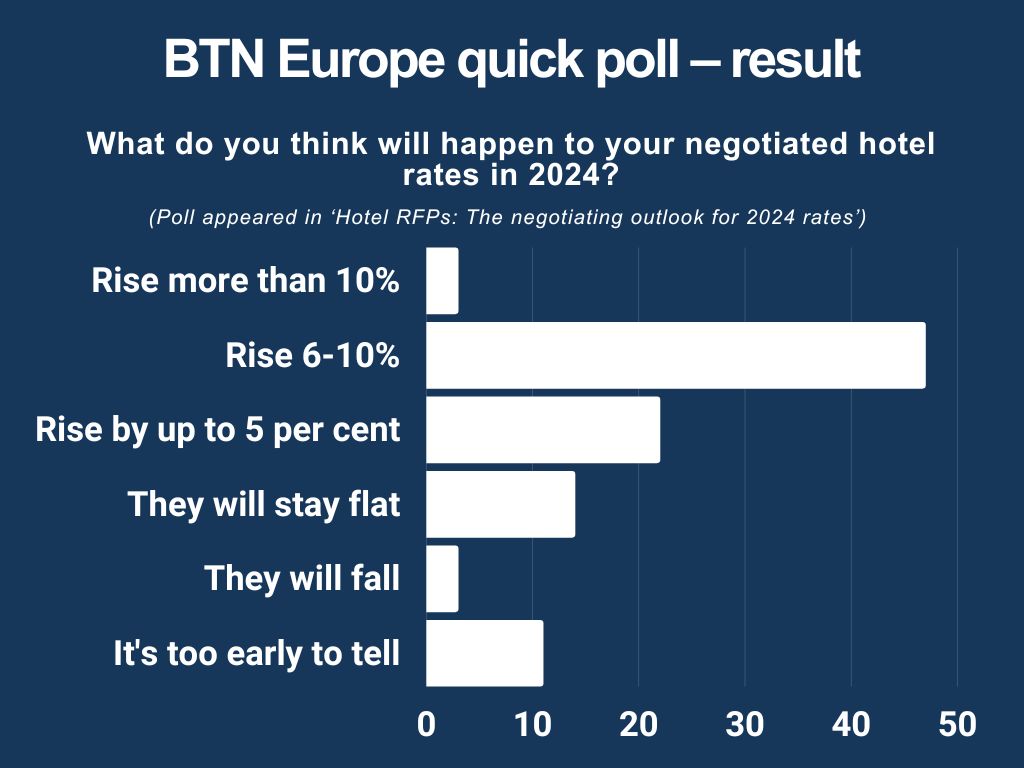

Last time: Hotel RFPs – The negotiating outlook for 2024 rates, poll result: