European hoteliers have cast longing looks to the United

States in recent months as its domestic market recovers at an impressive rate.

In Europe, the recovery is more protracted and, over the summer, was driven by

leisure rather than corporate business.

“We will have the best leisure summer we’ve ever had in the

history of this business is my guess,” Hilton CEO Christopher Nassetta said back in

June. “Business transient and group will take a bit longer to come back, but we

do have real reasons for optimism.”

In the UK, Premier Inn’s head of sales and distribution

David Cooney describes business travel as “a juggernaut coming up behind

leisure travel”. It’s going to come back, he believes, “but it’ll be a long,

slow burn”.

In its Q1 trading update published in mid-June, Premier Inn said UK accommodation sales were down 60.9 per cent compared

to the same period in 2019, but reported a “continued

gradual increase in business demand”.

At the start of July 98 per cent of its 800-plus UK hotels

were open, with business travellers accounting for a third of its guests compared to a near-even business/leisure

split in normal circumstances, says Cooney.

As vaccination programmes continue to penetrate Europe’s

populous, most in the industry still anticipate concerted corporate recovery in

the autumn. The speed and extent of that recovery is less clear.

“Hotels have outperformed air travel throughout the pandemic

because you have domestic markets [propping them up], but in the last four

weeks we’ve seen a real acceleration in hotel bookings driven predominantly

from North America. In Europe we’re seeing positive numbers but not at the same

level,” says Margaret Bowler, director of global hotel strategy at American

Express Global Business Travel.

“What’s interesting is that the customers who

kept going [during the pandemic] were more of the smaller and middle market

customers, but now we’re really noticing our bigger global customers are

starting to move again.”

THE RATES AND RFPs CONUNDRUM

As travel recovers, so will the hotel rates that had

plummeted during the pandemic. Last year, most hotel groups were quick to offer

corporates the opportunity to roll over the rates they’d negotiated for 2020

into 2021.

With staff shortages on the supplier and buyer side alike,

many took that opportunity but also added a safety net for when rates fell

below their corporate deal. It was very much a buyer’s market, but is that

changing as we enter the RFP season for 2022?

“Rates are still depressed but as each month goes by they’re

starting to rise in all regions. It’s double-digit growth in North America;

single digit in Europe,” says Bowler. “Hotel groups have learned from previous

world events that it takes a long time to grow your rate back.”

Premier Inn’s Cooney is under no illusion that rates will

bounce back quickly. “Our broad aim has simply been to fill hotels. Only now

are we really looking at rate opportunities. You need the volume back in the

business first,” he says.

And what of the future? “It’s too difficult to estimate.

You’ve got hybrid working policies now, it’s difficult to gauge how long the

online meetings phenomenon will last, and international demand is a big

mystery. What I can say is that it [rising rates] will be regional and

pocketed. In London and at airports it could be two years [until rates fully

recover].”

With rate recovery unclear, some hotel groups are again keen

to roll over corporate rates that were first negotiated in 2019. “They are

still good rates for hotels right now,” says Bowler.

On the other hand, Tripbam founder and chief executive Steve

Reynolds suggests that the trajectory of current rate recovery (see sidebar)

could mean hotel groups are keen to renegotiate. “Hoteliers are more motivated

to negotiate deals with you rather than just you rolling over, because those

2019 discounts will start to be acceptable. They will provide value [to buyers]

in the second half of the year, quite a bit of value in 2022.”

RATE WARNING

Current business travel volumes are about 30 per cent of 2019 levels, and average daily hotel rates remain lower as well but are increasing, writes Donna Airoldi.

The data was published in Tripbam’s second-quarter market report, which also said global hotel rates are up 10 per cent month over month and are on track to reach 2019 levels before year-end if they continue on that trajectory.

For travel buyers, “now is the time to hustle and get deals in place, or you could have a real challenge later this year,” said Tripbam founder and CEO Steve Reynolds. “I would say no later than the first quarter of next year, 2019 rates are here. In several markets, we’re seeing rates higher than 2019.”

According to the report, the best available rate for June was down 29 per cent from the same period in 2019, and booked rates were down 27 per cent, but that is “changing rapidly”. Global corporate booked rates rose 8 per cent month over month.

“The trend line is steep, which means rates are going up, and I don’t see anything in sight that will slow that down,” Reynolds said. “It’s another indication that revenue managers at hotels feel able to keep rates up because occupancy is getting higher.”

Indeed, Bowler has seen some cases of corporates who have

chosen to renegotiate with hotel groups emerge with higher rates than they had

previously.

Another complication at the negotiation table is that

corporates have no meaningful recent data – only numbers that are now several

years old. “The reality is that corporates are not going to have the same

travel habits as before and nobody knows the answer to how much that will be,”

says Bowler.

The best option, she believes, is to roll rates over again

but also secure a guarantee that, should the BAR float below the negotiated

corporate rate, the hotel group will offer them the lowest rate.

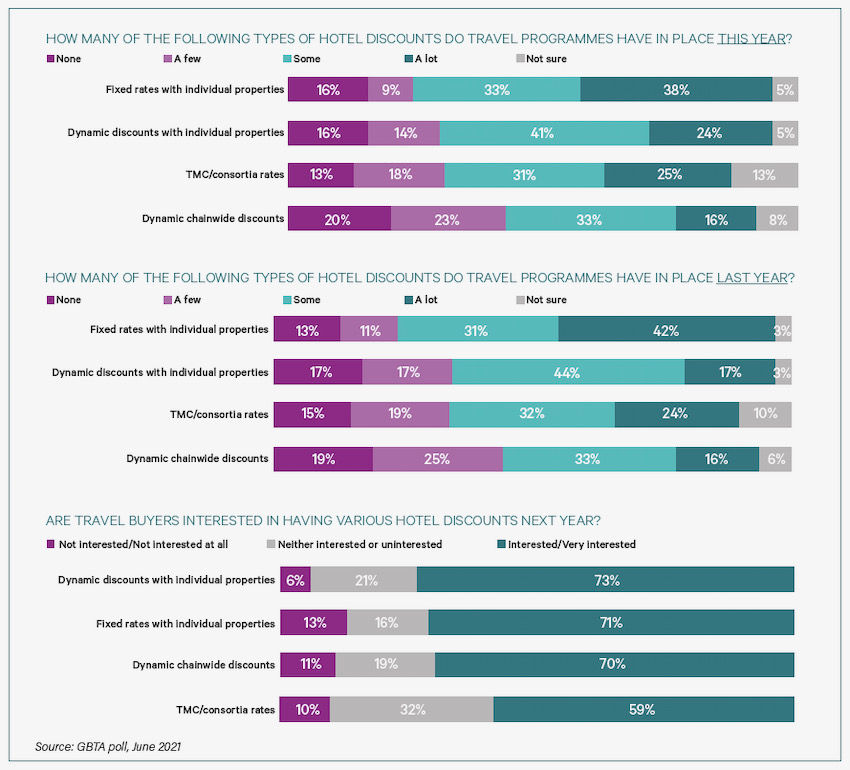

She adds: “Hotels are also really pushing dynamic pricing as

a model. The fundamental issue that corporates still have is that that’s great

in a market that’s depressed but in a market that’s coming back, there’s no

cap, so you win sometimes and you lose at others. The big issue there is

there’s no safety net. I don’t see fixed pricing in key locations going away

any time soon.”

Premier Inn’s Cooney says there is no mass clamour for negotiating rates

currently but he does expect that to pick up and to see more activity than last

year, with more active staff on both the supplier and buyer side than 12 months

ago. “New business has been relatively quiet through TMCs but busier through

Business Booker [the group’s direct booking and management portal for SME

customers]. We offer credit which is important to businesses right now.”

CHANGE MANAGEMENT

While many corporates stuck to their usual hotel category

during the pandemic rather than cautiously trading down, two notable changes

were observed: advance booking times fell and the average length of stay

increased. Will those trends last?

Amex GBT reports that, pre-pandemic, 23 per cent of hotel

bookings were made within three days of the stay. In May this year that figure

stood at 44 per cent. “That is because of a lack of certainty, but we are

seeing that decrease again now. Confidence is growing and people are booking

further out again.”

Meanwhile, the TMC also says length of stay has increased by

21 per cent in 2021 over 2019 as business travellers seek to combine more appointments

in the same trip. That trend is driven by both sustainability concerns and the

practicalities of organising travel in the current environment. Bowler believes

average length of stay will remain higher post-pandemic, but “not necessarily

21 per cent higher”.

Another area of interest has been the management of guest

expectations. TMCs and travel managers have worked hard to inform travellers

that their experience in the current environment is going to be very different

to what they would normally expect. In hotels, that can mean fewer staff, rooms

stripped of ‘high-touch’ items, and hotels and bars that remain fully or

partially closed.

“While we’ve been operating under government guidelines some

guests have been turning up with expectations that things are normal. They

don’t appreciate that room turnaround is longer or that it’s all table service

in bars and restaurants,” says Premier Inn’s Cooney. “Some guest behaviour has

been challenging”, he says, although that’s generally been in leisure hotspots

at weekends when occupancy has been at its highest.